Stop Diversifying Your Ad Budget

A lesson from the greatest investors ever

At least once a month, a fellow marketer laments to me about concentration risk in their advertising mix because of how much they spend on Meta and Google.

“If our winning ads fatigue, we’re screwed.”

“I’m worried Google incrementality drop as we scale.”

“We are so dependent on Instagram for new customers.”

These people are worrying about what happens if things go wrong, but if my current advertising ROI is strong, I shy away from diversification. Why? It’s simple. I want to deploy my ad dollars into my highest ROI ads.

In other words: “What happens if things go right?”

“Diversification is protection against ignorance. It makes little sense if you know what you are doing.” - Warren Buffett

This is true of advertising investments too and importantly, most of the people that lament to me know exactly what they are doing. They are some of the most skilled marketers at some of the best companies on the planet with near infinite upside.

Diversifying away from your best performing ads is akin to an investor selling their best investment to diversify into a worse one. All they are doing is insulating themselves from making more money.

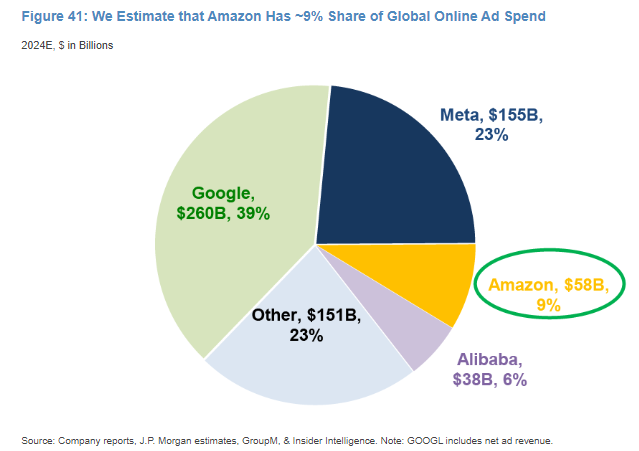

If you know what you’re doing and how your ads perform (most of my audience does!), you should concentration much more into your winners than the global average.

“The idea of diversification makes sense to a point - if you don’t know what you’re doing. If you want the standard result and don’t want to end up embarrassed - then of course, you should widely diversify. But nobody is entitled to a lot of money for holding this view. It’s like knowing 2 plus 2 is 4. Any idiot can diversify a portfolio.”

Charlie Munger