The rise and fall of in-house User Acquisition.

Over the past few years, there has been a massive shift toward the in-housing of advertising agency work. The Association of National Advertisers reports that 90% of brands say they’ve increased their in-house agency workload over the last year.

This is trend has held true for the clients we manage user acquisition for at Bamboo as well. Since we founded the business in 2014, “in-housing” is by far our #1 reason for logo churn. As you might imagine, I’ve analyzed our #1 reason for logo churn quite a bit.

When I do exit interviews with CEO/Founders, CMOs, and Growth Marketing Directors of brands who are churning, I usually hear some variation of:

“Bamboo has been a wonderful partner, but we always planned on bringing this in-house. It’s just way cheaper for us to do it that way.”

When comparing salary vs. fees, the “cheaper” argument has generally held true for our churned clients. We are usually more expensive than full-time equivalents. On a holistic cost basis, the “cheaper” answer has always been a bit more of a spectrum.

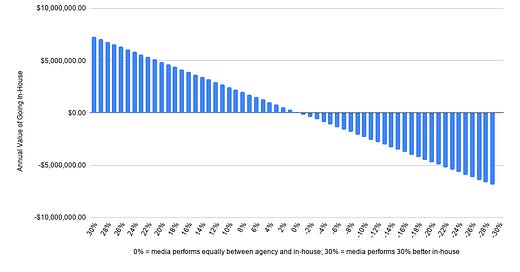

Below is an example cost spectrum for a client spending $12 million annually.

The graph compares an agency charges 6% of spend for media + creative support against the client hiring one in-house marketer and a creative resource to manage the media instead.

If performance between the two are equal, the client saves $80K (.6% of spend) annually in-house. 1% better media performance in either direction means the client saves $160K or $320K with agency or in-house respectively based on their choice.

If you want to run the interactive model for yourself, request access here.

Whenever we run these models, the data suggests that our focus should be on doing everything possible to improve advertising performance versus asking the agency vs. in-house question in the first place.

In-House Indigestion and the soon-to-be reversal

As I look toward the future and think about how our industry will evolve, I can’t help but believe that some of the biggest present day trends will bend our future in a direction that opposes the in-housing trends of late.

The In-House Growth Team is getting Bloated.

Just as ad agencies of bygone eras got fat and happy off of abundant budgets and low accountability, many in-house growth teams are now bloated with low productivity full-time staff. It seems many of these full-timers have been hired as a result of corporate social pressure more than corporate financial pressure.

I’ve interacted with multiple in-house advertising teams as of late who have ~1 full-time User Acquisition Manager per $100,000 in monthly advertising spend. They genuinely believed they were operating the highest ROI setup.

At some point soon, I believe that financial pressure will trump social pressure and brands will be looking at more financially rational resourcing.

Also read: Uber Lays off 400 from their Global Marketing Team.

The Automation of Ad Ops.

Thanks to incredible innovations by Facebook and Google (and the other digital ad networks soon to follow), User Acquisition Managers can now effectively manage 2x more ad spend than they could just a few years ago.

As this automation continues (what happens when we get to 10x more budget per User Acquisition Manager?), I believe that Fractional User Acquisition will become the gold standard for 90+% of advertisers.

Also read: Are mobile user acquisition teams shrinking?

The Creative Velocity Bar has raised — big time.

In addition to recent innovations in ad ops automation, the explosion of mobile video (Story placements, OTT video, etc) will force advertisers to meaningfully level up their ad production quality.

As a result, external paid social and mobile video partners like TubeScience, ReadySet, and Bamboo’s own Creative Studio are booming due to the fact that even very well staffed in-house growth marketing teams aren’t equipped with the production studios, actors, etc needed to drive world-class success today.

This need will only expand and Fractional Production will make more sense for most advertisers than building production studios in-house, especially if financial pressures are present.

Also read: User acquisition is dead. Creative is king.

The End of Growth At All Costs

Outside of the User Acquisition-specific trends listed above, there is a macro-trend starting to take hold that I believe will be a compounding force toward more rational goals and resourcing setups over the coming years.

The failed WeWork IPO, the public repricing of Uber and Lyft, and the tightening of Growth Stage Financing has quickly spread to almost every technology company. Almost over night, investors are now valuing contribution margins over revenue and fiscal responsibility over insane top line growth.

Also read: SoftBank’s Masayoshi Son mulls more cautious investment strategy

The last 5 years have been hallmarked by growth at all costs startups that have been given license to hire, license, and build whatever resources they need to hit their next top line goal. That era is coming to an end.

We’re now in the midst of a rapid, fundamental shift toward valuing rational growth.

I believe that means our future will look a lot different than the trends of the recent past and I believe that shared resourcing models will be a winner as a result.

If you want to chat more about the future of User Acquisition, shoot me email me at daniel@growwithbamboo.com.